The profit and loss statement will list revenues (from

sales or services provided), your cost for goods or services

provided, operating expenses (such as wages, rent, advertising),

and net income or loss. The basic formula is revenues minus

expenses equals income/profit. The categories of a profit

and loss statement are arranged in a specific order regardless

of the legal form of the business (i.e., sole proprietor, C

corporation, etc.). Also known as an Income Statement.

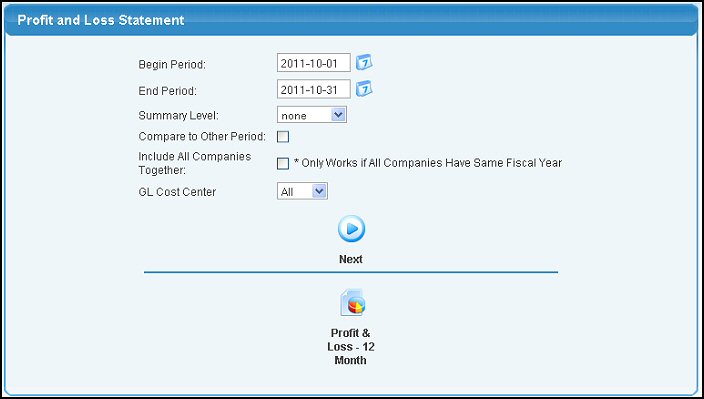

- To bring up the P&L Statement, select Reports -> Ledger -> Profit and Loss - Statement. Your screen should look similar to this:

- Begin and End Period: Use these boxes to enter the date range you would like covered in the report.

- Summary Level: Select Summary Level or STANDARD or NONE for what type of summarizing you want to do.

- Compare to Other Period: Check this box if you want to compare to another period besides YTD.

- Include All Companies Together: If you have created multiple companies, you can run a report for all companies combined provided they all have the same fiscal year.

- GL Cost Center: If you want to see a Profit and Loss for a specific Cost Center, select one from the drop-down list (you will only see these if you have created some).

- Click the

Next button to continue. Next button to continue.

- If you have the 12-Month Profit & Loss Add-On activated, you can click on the button at the bottom to jump to that report.

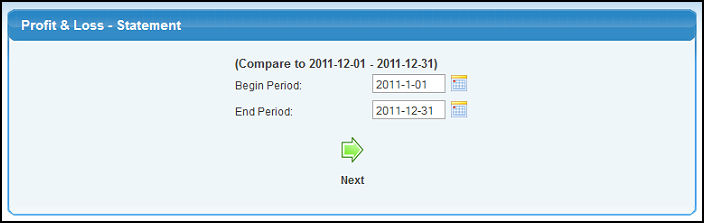

- If you are comparing multiple periods, your screen should look similar to

this:

- Use the Begin Period and End Period boxes to enter the year and month range for the second period.

- Click the

Next button.

Your screen should look similar to this: (if you are comparing to another period you will see more columns to the right for the comparison period). Next button.

Your screen should look similar to this: (if you are comparing to another period you will see more columns to the right for the comparison period).

- Click the

Back

button to return to the previous screen without saving the changes. Back

button to return to the previous screen without saving the changes.

- Click on any of the dollar amounts to bring up an Activity Report for this account for the period the column covers. (See Account Activity for details).

|

Next button.

Your screen should look similar to this: (if you are comparing to another period you will see more columns to the right for the comparison period).

Next button.

Your screen should look similar to this: (if you are comparing to another period you will see more columns to the right for the comparison period).

Back

button to return to the previous screen without saving the changes.

Back

button to return to the previous screen without saving the changes.