|

|

|

Enter Withholding and Tax Deduction Allowance tables. All table information should be entered for ANNUAL wages.

- From the Main Menu, select Payroll -> Tax Tables -> Edit Tax Table.

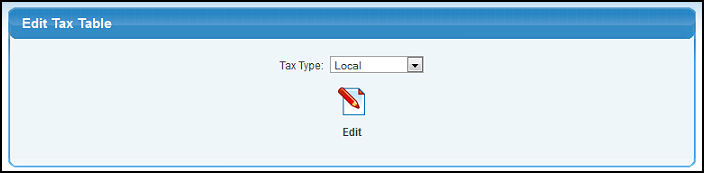

- Your screen should look similar to this:

- Select the Tax Type from the pull-down list. Choose from Federal, State, City, Local or Additional Tax type.

- To continue, click on the

Edit button. Your

screen should look similar to this (varying slightly by tax type): Edit button. Your

screen should look similar to this (varying slightly by tax type):

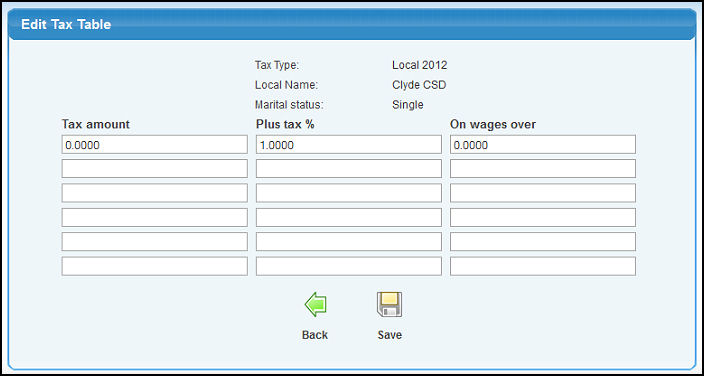

- Select the specific Tax and Year in the Tax Type pull-down list. Note: If you do not see your year listed, but you had used this tax in previous years, use the START NEW TAX YEAR option from the main tax table menu. Otherwise, you will need to create a new tax type with this year.

- Select Marital Status from the pull-down list. - Tax table for which marital status group.

- Check if you would like to see a Deduction Allowance Table (only some tax districts use these - they are credits for AFTER the regular tax is calculated.)

- To return to the previous screen to select a different type tax (such as Federal), click on the

Back button. Back button.

- To edit the tax table, click on the

Edit button. Your screen should look similar to this: Edit button. Your screen should look similar to this:

- Enter or update any or all the information in the table. Remember: these amounts and percentages are for AFTER exemption allowance has been taken. Most tax booklets have a section entitled "using the percentage method". You will need to use that section. Also remember to always enter ANNUAL tables. The software will break down actual taxes based on whether employee is weekly, bi-weekly, monthly, etc.

- To save your changes to the Tax Table, click on the

Save button. Save button.

- To return to the previous screen WITHOUT SAVING the changes, click on the

Back button. Back button.

| |

|