|

|

After all employee hours and misc. pay and deductions have been entered, you will next need to calculate the taxes, benefits, etc. If you wish to double-check your work of entering hours before calculating (a good idea when you are just getting started) you can run a Check Summary Report even though you have not calculated. Be aware the Check Summary Report will show the calculations, but will NOT include amounts in the Year-to-Date totals for any payroll not yet printed.

- From the Main Menu, select Payroll -> Calculations/Checks -> Calculate.

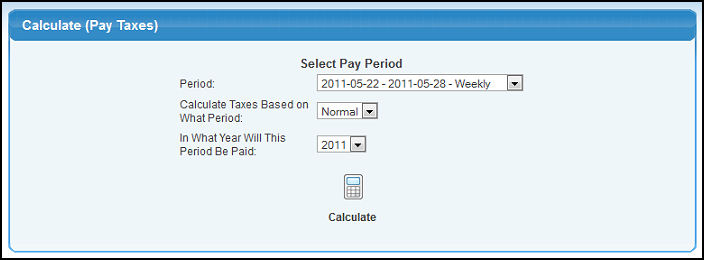

- Your screen should look similar to this:

- Make selections in the following categories:

- Period: Select the payroll period from the pull-down list (only uncalculated periods for which hours have been entered will appear on this list).

- Calculate Taxes Based on What Period: Select how you want taxes to be calculated on this payroll period. This selection allows you to tax special mid-period payroll runs (such as bonus runs) differently. Your choices are Normal, Month, Quarter, or Year.

- Normal - Taxes will be calculated as they are during a normal payroll period for this pay cycle. All deductions will be taken using this choice.

- Month, Quarter or Year - Taxes will be calculated on a monthly, quarterly or annual basis. For example, to calculate Federal Income Tax on a $500 bonus using the monthly option, the bonus amount will be multiplied by 12, exemptions subtracted, annual taxes calculated and the amount divided by 12 to result in a tax amount based on a monthly tax base.

- In What Year Will This Period Be Paid: This will default to the year of the END of the payroll, but at the end of the calendar year, you may want to change to show what year the CHECK will be written (and what tax table to use), as that is what the W2's look at when deciding which payrolls to include in totals.

- To calculate, click on the

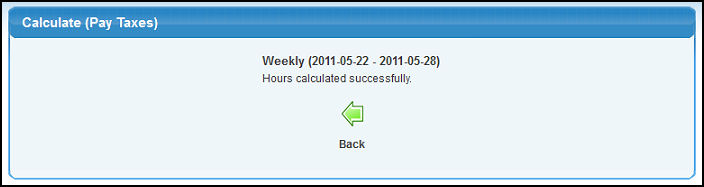

Calculate button. Your screen should look similar to this: Calculate button. Your screen should look similar to this:

- To return to the previous screen to calculate payroll for another group, click on the

Back button. Back button.

| |

|

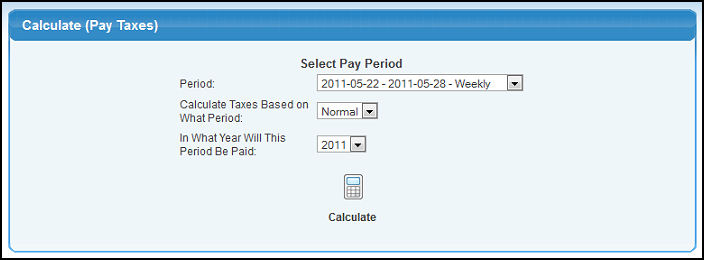

Calculate button. Your screen should look similar to this:

Calculate button. Your screen should look similar to this:

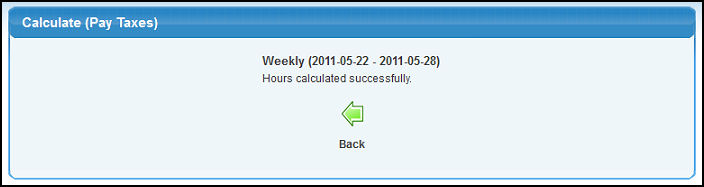

Back button.

Back button.