|

|

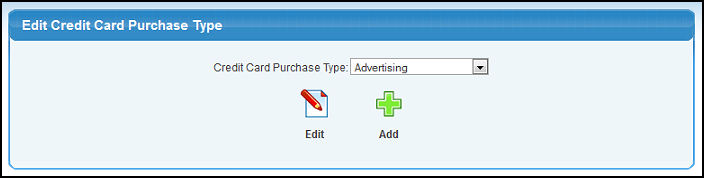

Enter the types of expenses for which you use your credit cards.

- From the Main Menu, select Payables -> Credit Card Bills -> CC Purchase Types.

- Your screen should look similar to this:

- Click the

Add button to create a charge type. Add button to create a charge type.

- Click on the

Edit button to edit an existing charge type. Edit button to edit an existing charge type.

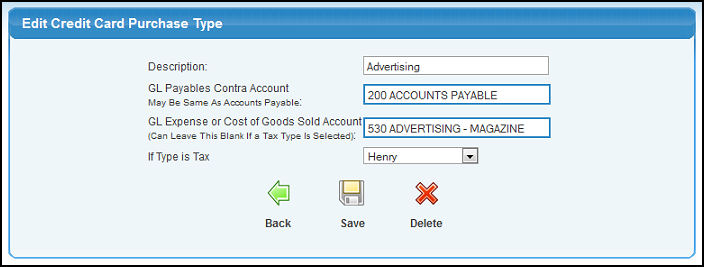

- Whether editing or adding, your screen will look similar to this:

- Credit Card Purchase Type Description: Enter a description for the type of purchase this represents.

- GL Payables Contra Account: Although you can use your general payables account here, if you want a "holding" type of account that clears out when the actual bill is received, you can create a special type of payables account for tracking the pending credit card charges. Enter the account name (or a partial name) to bring up a drop-down of possible matches.

- GL Expense or COGS Account: This will be the expense side of the General Ledger entry. Enter the account name (or a partial name) to bring up a drop-down of possible matches.

- If Type is Tax: If the purchase type is TAX, then you can select from the drop-down list for the type of sales tax. This is mostly important for VAT type companies.

- To return to the previous screen WITHOUT SAVING your changes, click on the

Back button. Back button.

- Click on the

Save button to save the data. Save button to save the data.

- Click on the

Delete button to delete this charge type. Delete button to delete this charge type.

| |

|