Use this section to copy the Payroll Tax Tables into a new year. The original tax table remains in the system. NOTE: Unemployment rates are specific to your company and will need to be verified after creating the tables.

- From the Main Menu, select Payroll -> Tax Tables -> Start New Tax Year.

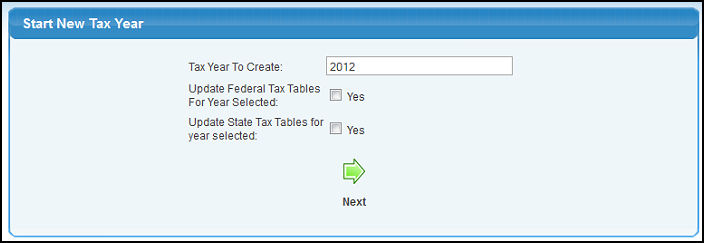

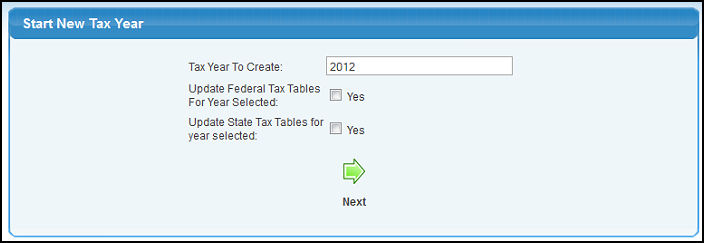

- Your screen should look similar to this:

- Make your selections as listed below:

- Tax Year to Create: Select the new year where you want to create the tax table. The most recent year found will be used to copy into the year entered here. Federal, State, City, Local and Other tax tables will be copied into the new year.

- Update Federal Tax Tables For Year Selected: If you have purchased this ADD-ON FEATURE, you can check this box to have the system download the latest federal tax tables for the year selected.

NOTE: If you have just activated your add-on feature for Federal Tax Tables, you must first go to Tax Type Add and add the Federal Tax Type. Then you can start the new tax year for the current year.

- Update State Tax Tables For Year Selected: If you have purchased the Federal Tax Tables Add-On you can also update State Tax Tables. Make sure you have first created a State Tax Type.

- To copy the tax tables, click the

Next button. Next button.

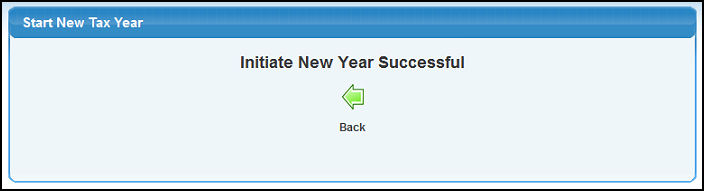

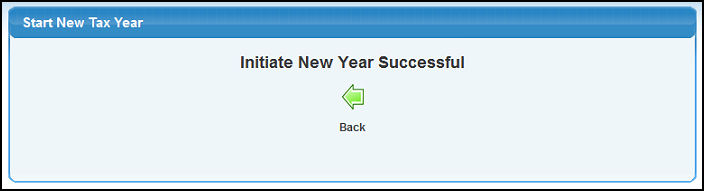

- You will see a screen indicating the initialization of the new payroll tax tables has been successful. Your screen should look similar to this:

- To return to the the previous screen, click the

Back button. Back button.

|

Next button.

Next button.