| Using NolaPro > Reports > Billing |

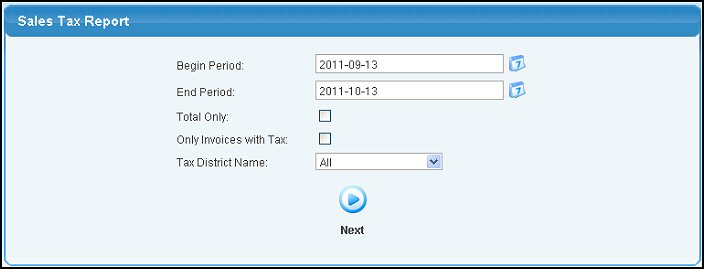

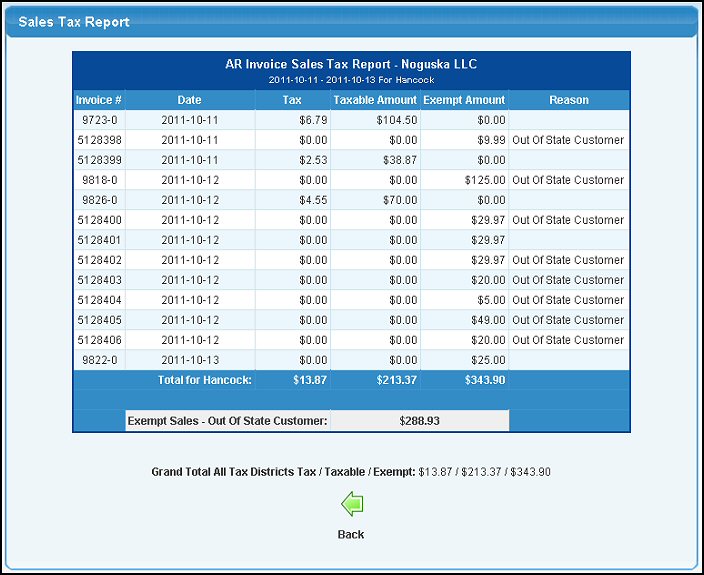

Sales Tax Report

Sales tax received between the two dates entered. This report can be used to help you complete your month-end, quarter-end and even your year-end sales tax reports.

In addition to showing each individual invoice and whether it is taxable or exempt and if exempt, why... It also totals at the bottom: Total Tax, Taxable $$, Exempt $$, and then the totals for exemption reasons by reason. You may notice that some invoices will have entries in BOTH exempt and taxable columns. This is because invoices can be taxed for some line items and not others. Also, non-taxable shipping will appear in the exempt column as well. VAT Tax Report

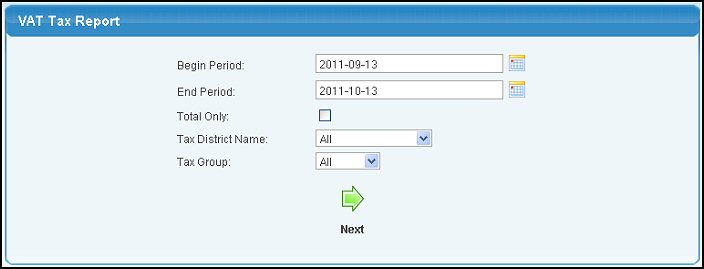

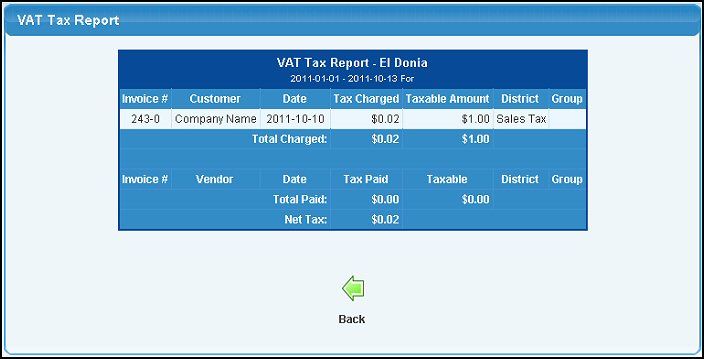

Vat taxes received and paid between the two dates entered. This report can be used to help you complete your month-end, quarter-end and even your year-end VAT tax reports.

In addition to showing each individual receivables invoice and the amount of tax charged and the taxable amounts, it then shows Misc. Sales receipts. It also totals the taxes charged at the bottom of that section. In the next section, it shows each individual payables invoice and the amount of tax paid, with totals at the bottom of that section. Then, at the very bottom, is the net tax due. |