|

|

If a payment gets entered in error, then Void Payments is the way to back out the payment, so it can be put in correctly. This is also where bad debt write-offs can be reversed.

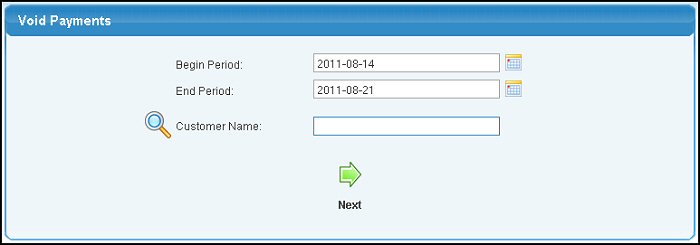

- From Main Menu select Billing -> Invoices -> Void Payments. Your screen should look similar to this:

- Begin Period: Enter the beginning payment date to search for the payment to be voided. Click on the calendar icon to help select the date.

- End Period: Enter the ending payment date to search for the payment to be voided. Click on the calendar icon to help select the date.

- Customer Name: To search for payments made by a specific customer, enter the customer name to see a pull-down list, enter the customer number, or use the

Lookup button to find the customer number. Lookup button to find the customer number.

- Click on the

Next button to proceed to the next screen which will look similar to this: Next button to proceed to the next screen which will look similar to this:

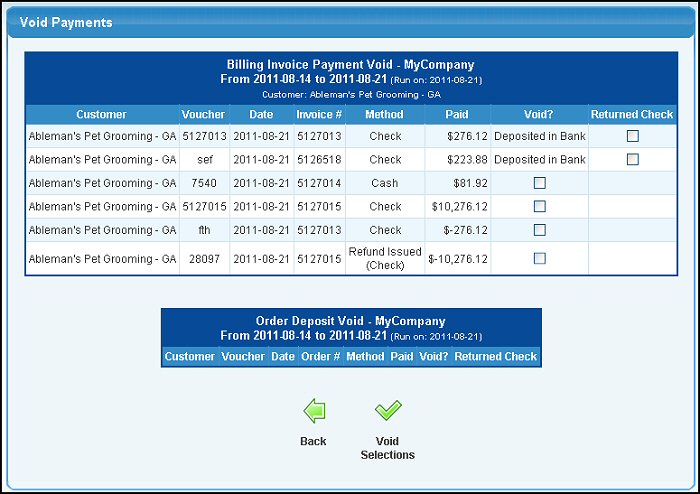

- Check the box next to any payment to be voided. When you have selected the payments to void, click on the

Void Selections button to actually process the voids. Void Selections button to actually process the voids.

- Check the box in the RETURNED CHECK column if the payment has already been deposited in the bank, but has bounced or been refused.

- When voiding a payment, it backs the payment out of the invoice and general ledger. If the invoice was closed by this payment, it will re-open the invoice.

- Payments by check that have been deposited in the bank and have cleared the bank show "Deposited in Bank" and cannot be voided unless marked as Returned. Any check payments that have been deposited in the bank and are returned due to insufficient funds, can be marked as Returned. This "undeposits" the check and allows you to void the payment if necessary.

| |

|