|

|

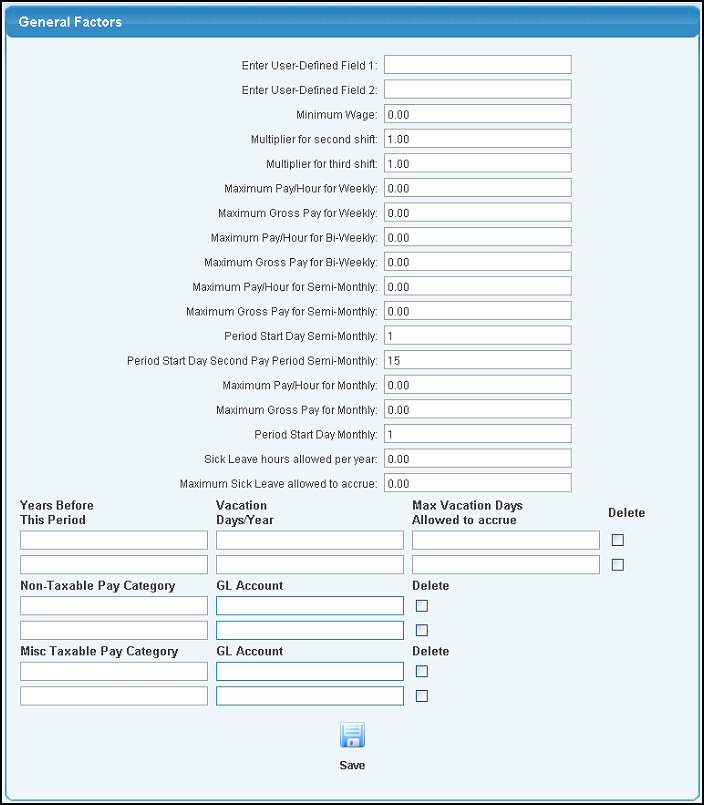

Set up your maximum pay, shift multipliers, vacation and sick leave benefits.

- From the Main Menu, select Admin -> Setup - Payroll -> General Factors.

- Your screen should look similar to this:

- Enter data into the following categories:

- Enter User Defined Field #1: User defined prompt that will appear on the employee data screen.

- Enter User Defined Field #2: User defined prompt that will appear on the employee data screen.

- Minimum Wage: Enter the current minimum wage rate. This is needed to make sure pay rates are above the minimum and that tips as wages are calculated correctly.

- Multiplier for second shift: If you have a wage differential for second shift work, enter the multiplier here.

- Multiplier for third shift: If you have a wage differential for third shift work, enter the multiplier here (multiplied times regular pay).

- Maximum Pay/Hour Weekly: This prevents users from being able to enter a higher than allowed wage into the employee records.

- Maximum Gross Pay for Weekly: This prevents a single pay-check from exceeding the maximum allowed.

- Maximum Pay/Hour Bi-Weekly: This prevents users from being able to enter a higher than allowed wage into the employee records.

- Maximum Gross Pay for Bi-Weekly: This prevents a single pay-check from exceeding the maximum allowed.

- Maximum Pay/Hour Semi-Monthly: This prevents users from being able to enter a higher than allowed wage into the employee records.

- Maximum Gross Pay for Semi-Monthly: This prevents a single pay-check from exceeding the maximum allowed.

- Period Start Day Semi-Monthly: The day of the month your first semi-monthly pay period begins.

- Period Start Day Second Pay Period Semi-Monthly: The day of the month your second semi-monthly pay period begins.

- Maximum Pay/Hour Monthly: This prevents users from being able to enter a higher than allowed wage into the employee records.

- Maximum Gross Pay for Monthly: This prevents a single pay-check from exceeding the maximum allowed.

- Sick Leave Hours Allowed per Year: When paying employees, the system will check to see how much sick leave has accrued, and if not enough, it will not allow for paid sick leave.

- Maximum Sick Leave allowed to accrue: This will prevent sick leave from being SAVED UP for multiple years, then used all at once.

- VACATION:

- Years Before This Period: How long does an employee have to work with the company before they accrue vacation at the rate given on this line.

- Vacation Days/Year: How many vacation days are allowed per year in this time period.

- Max Vacation Days Allowed to Accrue: After accruing this many vacation days the employee cannot accrue any more until some of the days are used.

- Delete: Check this box to delete this line of vacation accrual information.

- Non-Taxable Pay Category: When entering non-taxable pay during log hours, you can select from pre-defined descriptions for tracking types of non-taxable pay, and you can select different GL accounts for each of these as well.

- Description: Description of non-taxable type of pay.

- GL Account: Account to post expense to for non-taxable pay.

- Delete: Check this box to remove this entry the next time you save..

- Misc Taxable Pay Category: When entering misc. taxable pay during log hours, you can select from pre-defined descriptions for tracking types of misc. taxable pay, and you can select different GL accounts for each of these as well.

- Description: Description of type of pay.

- GL Account: Account to post expense to for misc. taxable pay.

- Delete: Check this box to remove this entry the next time you save.

- To save your changes, click on the

Save button. Save button.

| |

|