|

|

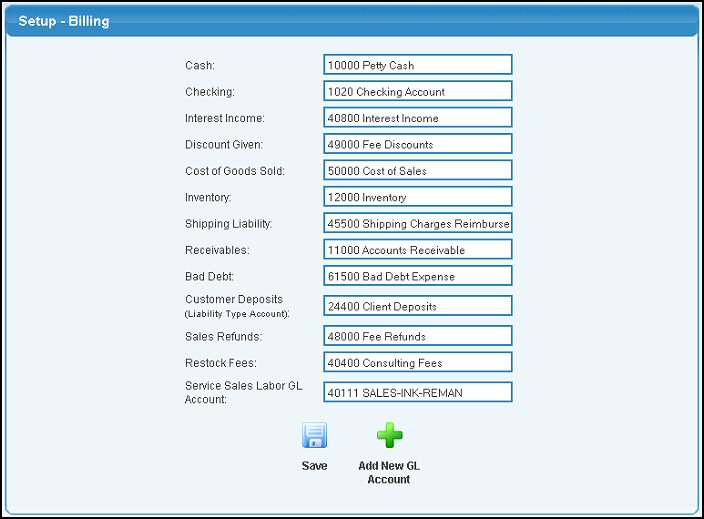

Use this chapter to enter/update standard posting accounts

to be used by Accounts Receivable when posting data to the

General Ledger.

- From the Main Menu, select Admin -> Setup Receivables -> General Setup.

- Your screen should look similar to this:

- Complete the information in the following categories:

- Cash: When entering CASH receipts, this is the GL account to be posted to.

- Checking: When receiving CHECKS, etc., this is the GL account to be posted to.

- Interest Income: This account is only used if the customer PAYS interest. You may accrue interest on their account that they do not pay.

- Discount Given: If you extend discount terms to your customers, this is the GL account that should post to.

- Cost of Goods Sold: The default cost of sales account. (you can enter another number at the time of invoicing if desired).

- Inventory: When you enter cost of sales, the opposite entry to that in the GL is inventory (inventory reduced, cost of sales increased).

- Shipping Liability: Shipping charges are pass-through amounts. The customer pays them, but you then pay UPS or whomever. This is the Payables account for shipping.

- Receivables: Open Account invoices post originally to this GL account, and when the invoice is paid, it reduces this account (which is an asset account).

- Bad Debt: The default account used for Bad Debt entries.

- Customer Deposits: The default account when a customer puts a deposit down on an order.

- Sales Refunds: Checks written to refund credit balances will be posted to this account.

- Restock Fees: Where restock fees collected should be posted.

- Service Sales Labor GL Account: The default account for Labor entries on Service Orders.

- Click the

Save button to save changes. Save button to save changes.

- Click the

Add New GL Account button to add new GL Accounts. Add New GL Account button to add new GL Accounts.

| |

|